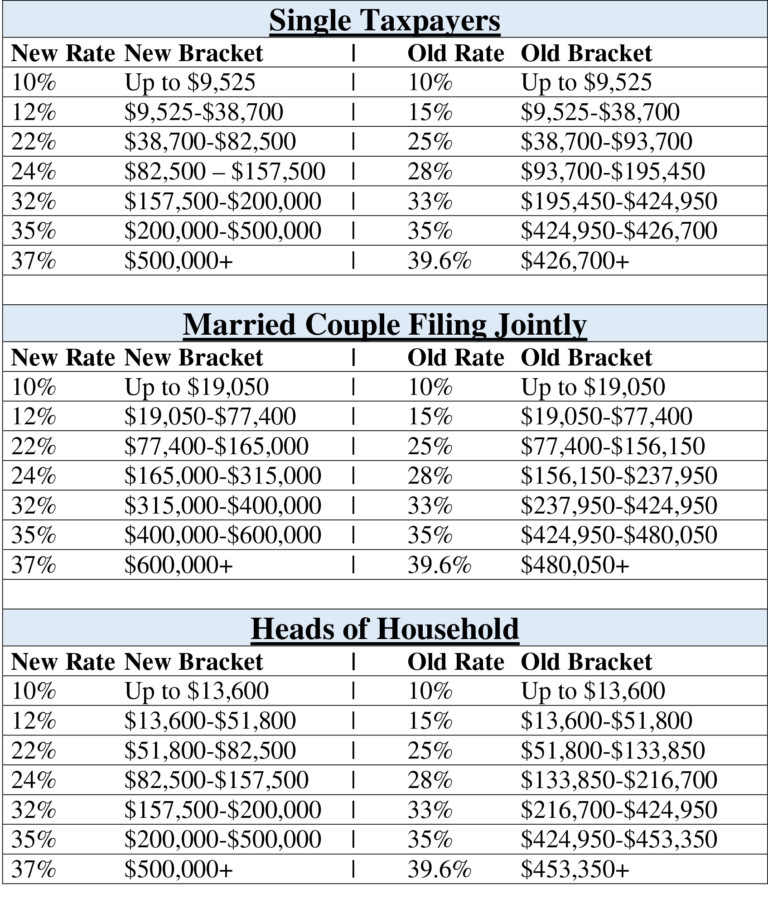

The effective marginal tax rate for individuals is the percentage of an additional dollar of earnings that is unavailable because it is paid in taxes or offset by reduced benefits from government programs. For a corporation, the effective marginal tax rate is its tax burden on returns from a marginal investment (one that is expected to earn just enough, after taxes, to attract investors). Another measure-the effective marginal tax rate on capital income-is broader than the effective marginal corporate tax rate, because it also accounts for the taxes paid by individuals on interest, dividends, capital gains, and the profits of businesses not subject to the corporate income tax. For corporations, the average tax rate is calculated by dividing corporate tax liability by before-tax profits.ĬBO’s measures of effective tax rates, however, vary by type of tax unit and form of income. For individuals, CBO computes the average tax rate by dividing individual tax liability by before-tax income. And the range of income subject to each of those rates. The measure of average tax rates is similar for individuals and corporations. Income tax brackets There are seven different federal income tax rates at which earned income is taxed: 10, 12, 22, 24, 32, 35 and 37. CBO periodically analyzes two alternative measures of tax rates that are affected by many of those provisions: the average tax rate and the effective marginal tax rate.

Income tax brackets: The ranges of income to which a tax rate applies (currently there are seven as shown above).

Tax brackets free#

Other provisions in the tax code-including tax preferences and surtaxes-also affect taxpayers’ decisions and the distribution of taxes. In 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Tables 1). Income tax rate: The various percentages at which taxes are applied. Want to know your tax bracket for the current tax year TaxActs free tax bracket calculator is an easy way to estimate your federal income tax bracket and. The federal income tax rates for 2022 did not change from 2021. whether you are single, a head of household, married, etc). minimum tax is calculated as a percentage of your federal minimum tax and is currently 33.7%.The statutory tax rate structure, which is set by law, is one of the many features of the tax system that influence taxpayers’ behavior and that also contribute to the distribution of tax burdens across households. Filing status and federal income tax rates 2022 tax year 12. The federal tax brackets are broken down into seven (7) taxable income groups, based on your federal filing statuses (e.g. Prizes (P10,000 or less ) Graduated Income Tax Rates - Over P10,000: 20: 4. Royalties (on books as well as literary & musical compositions) 10 - In general: 20: 3. If you're subject to minimum tax under the federal Income Tax Act, you're also subject to B.C. Interest from currency deposits, trust funds and deposit substitutes: 20: 2.

Tax rates are applied on a cumulative basis. Personal income tax brackets and rates - 2023 tax year Taxable Income - 2023 Brackets For the 2023 tax year, the tax brackets were increased from the previous year by a BC CPI rate of 6.0%.

0 kommentar(er)

0 kommentar(er)